Engaging Data vs FIREkit: Which FIRE Calculator is Better for Your Retirement Plan?

Quick Links

If you're in a hurry and just want to test both tools yourself:

Why Simple Retirement Calculators Matter

Planning for early retirement is both exciting and challenging. There are so many factors to consider - investment returns, inflation, savings growth, the 4% rule, retirement spending, and others - it's easy to feel overwhelmed. That’s why simple yet effective early retirement calculators are essential. They allow users to quickly understand key financial parameters, experiment with different scenarios, and estimate when they can safely retire.

Among the many options available, two stand out: FIREkit Retirement Calculator and Engaging Data FIRE Calculator. Both tools help estimate your FIRE (Financial Independence, Retire Early) date, but they differ in approach and assumptions. In this article, we’ll compare these calculators using a real-life scenario to see which one offers the most accurate and practical insights.

How We Compare FIRE Calculators

A good retirement calculator should be evaluated based on the following factors:

- Completeness: Whether the calculator considers all critical financial variables, such as inflation, life expectancy, and spending patterns.

- Accuracy: How realistic and reliable the predictions are, particularly in long-term retirement scenarios.

- Ease of Use: How intuitive and user-friendly the tool is for an average user.

- Features: Unique functions like Monte Carlo simulation, allocation breakdowns, and alternative retirement strategies.

- Affordability: Whether the calculator is free to use or requires payment for access.

Quick Estimates vs Real Planning

It’s important to note that retirement calculators are great for a quick understanding of financial parameters, but they shouldn’t be solely relied on for real planning. Both of them are useful for testing different scenarios, however for actual retirement planning, using a more comprehensive tool like 🚀 FREE FIREkit Retirement Planner is recommended, as it considers different assets, liabilities, future goals, and expenses. It is designed in mind for serious financial planning with more realistic assumptions.

Meet Bob: Our Retirement Planning Example

To make this comparison realistic, let’s introduce Bob, a 32-year-old who wants to retire as soon as possible. Here are his financial details:

- Initial balance: $150,000

- Monthly savings: $800

- Annual Profitability: 7%

- Annual Savings growth: 5%

- Annual Inflation: 3.27%

- Monthly Retirement spending: $1,800

- Annual Retirement profitability: 4%

- Age: 32

- Life expectancy: 95

Now, let’s put Bob’s numbers to the test! We’ll feed his financial details into both calculators and see how they measure up - who will give him a realistic retirement date, and who will leave him dreaming too soon?

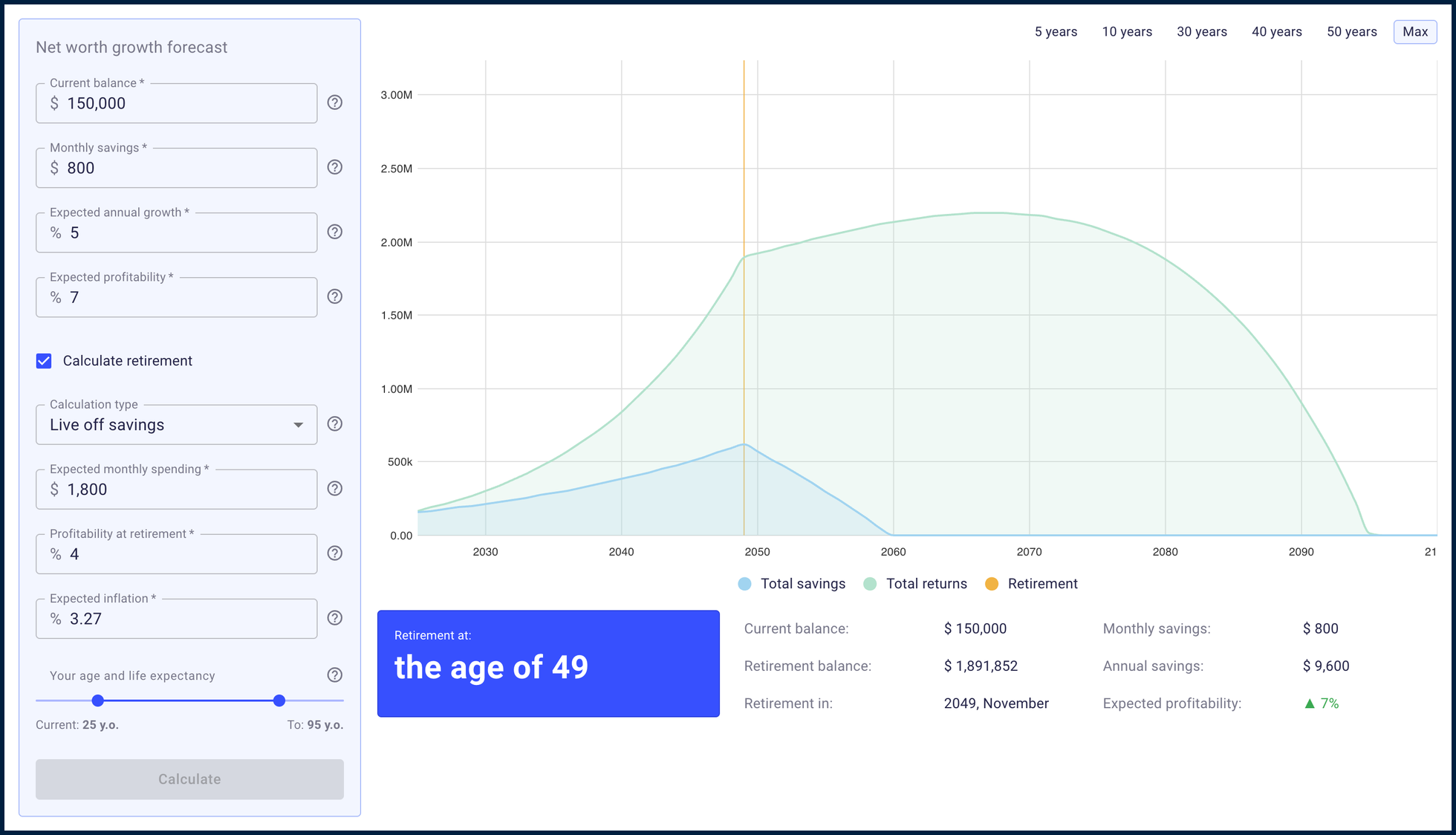

FIREkit FIRE Calculator Results

FIREkit’s binary search method finds the optimal retirement date based on real-world constraints, including inflation and life expectancy. According to its projections, Bob can retire at age 49. His ending balance at retirement would be $1,891,852, ensuring long-term security even after adjusting for inflation and extended life expectancy.

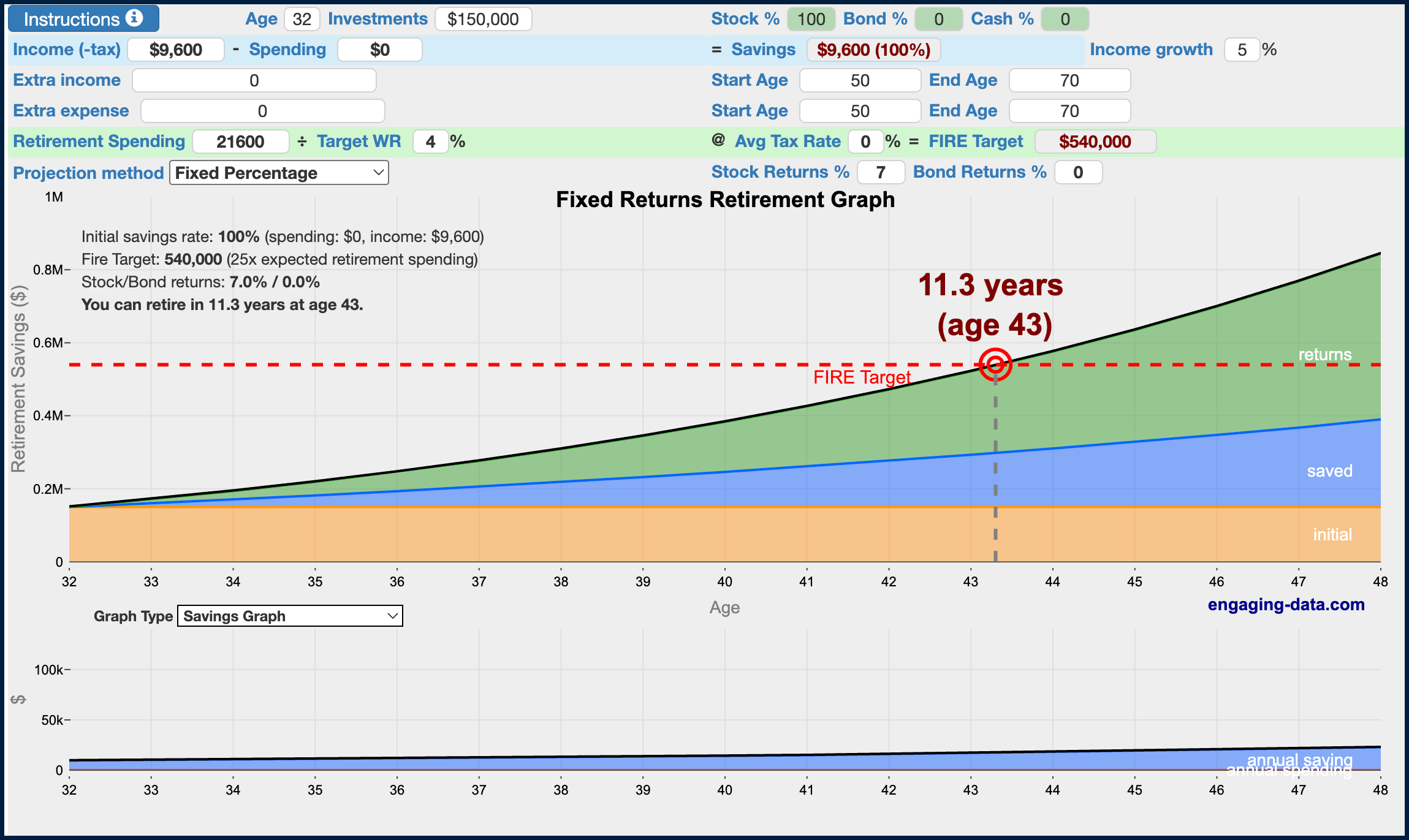

Engaging Data FIRE Calculator Results

Engaging Data’s simulation provides a different approach but lacks inflation and life expectancy adjustments. According to its projections, Bob can retire at age 43 with an ending balance of $540,000. However, because the calculator does not factor in inflation, this amount may not be sufficient for long-term retirement security.

Which One Is More Reliable?

One of the most striking differences between the two calculators is how they treat inflation and life expectancy.

- Engaging Data FIRE Calculator estimates that Bob can retire at 43 years old with $540,000, but it does not account for inflation or the fact that Bob will need his savings to last until age 95.

- FIREkit FIRE Calculator factors in inflation (3.27%) and life expectancy (95 years), leading to a more realistic retirement age of 49 and an end balance of $1,891,852.

Had Bob followed the Engaging Data suggestion and retired at 43, he might have found himself running out of money too soon 😬. FIREkit ensures that he can sustain his lifestyle for the long haul.

| Factor | FIREkit FIRE Calculator | Engaging Data FIRE Calculator |

| Completeness | ✅ Covers essential factors | ⚠️ Lacks key assumptions, like inflation and life expectancy |

| Accuracy | ✅ More realistic and reliable | ⚠️ Overly optimistic (no inflation) |

| Ease of Use | ✅ Simple and intuitive | ❌ Geeky UI, needs time to understand |

| Features | ✅ Monte Carlo simulation, allocation to Stocks/Bonds/Crypto | ✅ Binary search retirement, different retirement strategies |

| Affordability | ✅ Free for all users | ✅ Free for all users |

Overall Score

- ✅ FIREkit: 9/10 - It’s highly accurate, easy to use, and factors in all key financial variables, making it the best choice for quick planning.

- ⚠️ Engaging Data: 6/10 - It’s great for getting a quick snapshot of your potential FIRE path. However, because it lacks key elements like inflation and life expectancy, its long-term reliability is limited.

Final Verdict: Which Calculator Should You Use?

The comparison makes one thing clear: if you want a realistic and reliable plan for your FIRE journey, FIREkit is the better choice. It considers inflation, life expectancy, and long-term financial security, ensuring that you won’t outlive your savings. Unlike simpler calculators, FIREkit provides a sustainable and well-rounded approach to retirement planning.

When planning for FIRE, assumptions matter. While the 4% rule and compound interest are useful guidelines, ignoring inflation and life expectancy can lead to misleading results. FIREkit helps you build a financial future that lasts a lifetime, not just on paper.

Ready to Plan Your Financial Future?

🔥 Try the FIRE Calculator today and plan your financial future with confidence!

Read more