Coast FIRE Calculator: Achieve Financial Independence Without Extra Contributions

In the world of personal finance and retirement planning, Coast FIRE has emerged as a powerful concept for those who want to achieve financial independence and retire early, without continuously contributing to their savings. If you're looking for a way to retire early but don't want to sacrifice your current lifestyle or make continuous contributions to your retirement funds, Coast FIRE might be the solution you're looking for.

Don't want to read the article? Jump straight to the free Coast FIRE calculator and find out when you can retire!

What is Coast FIRE?

Coast FIRE (Coast Financial Independence, Retire Early) is a strategy that allows you to stop actively saving for retirement once you've accumulated a sufficient amount of money. The key idea behind Coast FIRE is that, with your current savings and the power of compound growth, your money will continue to grow on its own over time. This means you no longer have to worry about adding to your investments. Instead, you can focus on living your life while knowing that your existing investments will carry you to financial independence by the time you're ready to retire.

How Coast FIRE Works

Unlike traditional FIRE strategies, which involve a high level of sacrifice and saving aggressively until you hit your retirement goal, Coast FIRE is more about finding the right moment when your investments are set to grow and cover your retirement needs. The strategy focuses on reaching a point where you can stop contributing to your retirement fund but still retire comfortably without depleting your savings prematurely.

Why Traditional Retirement Calculators Fall Short

Traditional retirement calculators often rely on a fixed target amount (the sum you need to retire) and suggest how much to save each month to reach that goal by a certain age. However, this approach doesn't account for the dynamic nature of personal finances, where inflation, investment growth, and withdrawal needs constantly change. As a result, the amount needed to retire isn't a static number, making traditional calculators unrealistic in predicting your actual retirement needs.

Therefore your retirement date is NOT REAL!

How We Solve This with Coast FIRE

Unlike traditional calculators, our Coast FIRE calculator accounts for these dynamic changes by using a binary search to find the exact date and amount when your existing savings will allow you to retire comfortably. Here's how it works:

- Dynamic Growth: Instead of assuming a fixed target sum, our calculator projects how your current savings will grow over time based on realistic investment returns.

- Inflation and Withdrawal Rate: We consider the impact of inflation on your purchasing power and simulate your annual withdrawals to cover living expenses, adjusting for the future cost of goods and services.

- Precise Retirement Date: Through binary search, the calculator determines the exact date when your savings will be sufficient to retire, ensuring that your money will last throughout your retirement, accounting for all the factors that could affect your finances.

This approach gives you a much more accurate and realistic prediction of when you can safely retire, taking into account all of the uncertainties that traditional calculators miss.

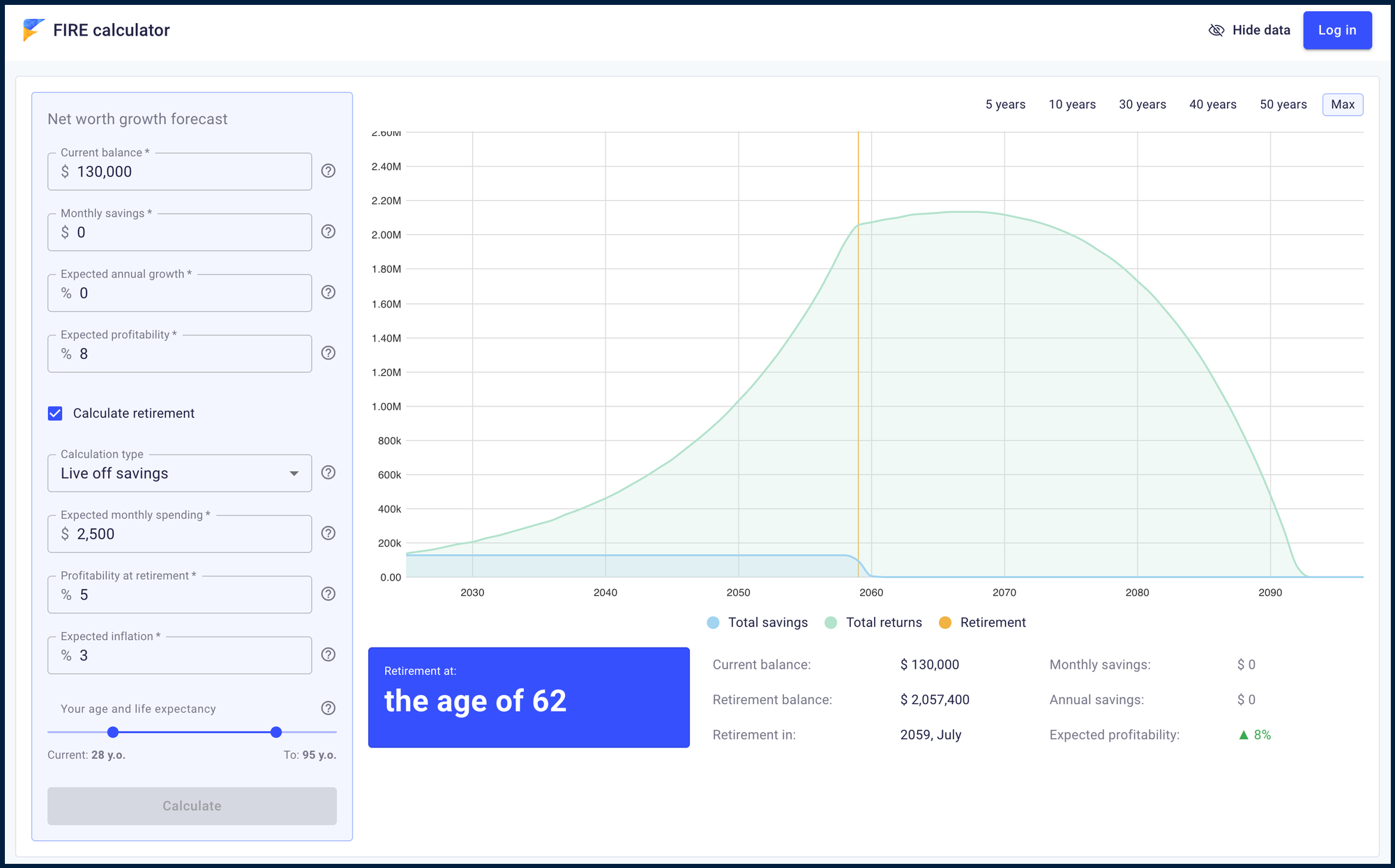

Example Calculation Using the Coast FIRE Calculator

Let’s walk through an example to see how Coast FIRE works in practice. Meet Bob, a 28-year-old with a strong start on his financial journey. With $130,000 in savings and an annual investment return of 8%, Bob is well on his way to building wealth. He plans for his retirement early, factoring in an annual return of 5% on his retirement investments and withdrawing $30,000 each year once he retires.

Scenario:

- Current age: 28

- Current savings: $130,000

- Annual investment return: 8%

- Annual retirement investment return: 5%

- Annual retirement withdrawal: $30,000

- Inflation rate: 3%

Using these inputs, our free Coast FIRE calculator predicts that by the time you reach 62 years old, you will need $2,057,400 in your retirement fund. This sum will allow you to withdraw $30,000 annually, adjusted for inflation, without depleting your savings before your expected life expectancy.

Coast FIRE vs. Other FIRE Strategies

While Coast FIRE is an attractive option for some, it’s important to understand how it compares to other FIRE strategies.

😊 Lean FIRE

Lean FIRE is for those who aim to retire early with minimal living expenses. It requires aggressive savings and lifestyle changes to retire on a small budget.

😎 Fat FIRE

Fat FIRE, on the other hand, requires saving much more aggressively in order to maintain a higher standard of living in retirement. It focuses on larger savings and larger withdrawals.

☕ Barista FIRE

This strategy involves working part-time during retirement while your investments continue to grow. It's ideal for those who don’t want to fully stop working but want more flexibility.

🏖️ Coast FIRE is unique because it’s about finding the point at which you can relax and let your investments grow without worrying about making additional contributions. It’s perfect for those who want to retire early but don’t want to go through the extreme sacrifices that come with other FIRE strategies.

Conclusion

Coast FIRE is a fantastic strategy for those looking for financial independence without sacrificing their current lifestyle. By using our FIRE calculator, you can easily determine when your savings will be enough to retire comfortably, based on your current financial situation, expected returns, and future withdrawals.

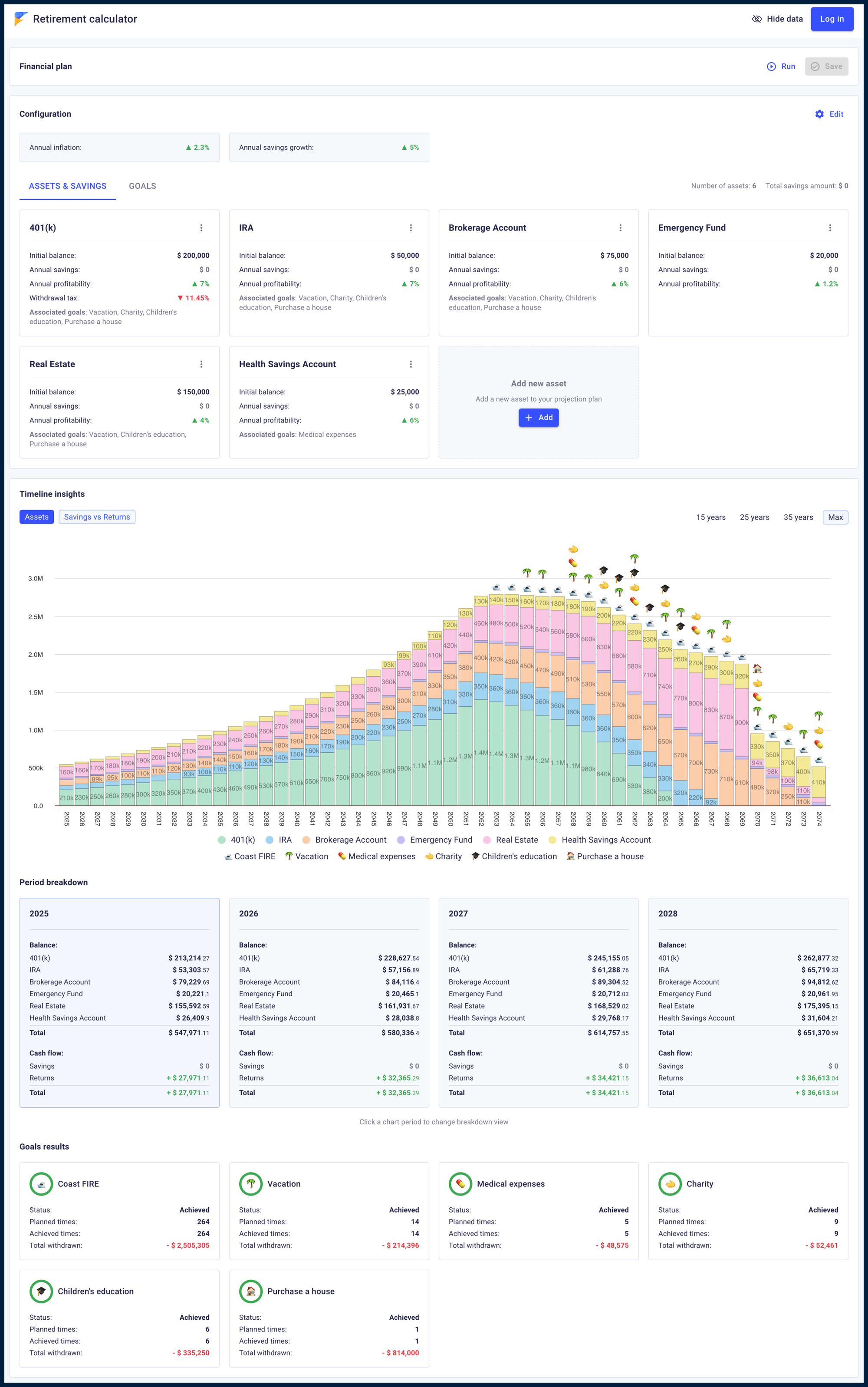

To plan your retirement more precisely, try using our free retirement planning tool, which is also suitable for coast retirement planning. It helps you create a detailed growth strategy, set your goals, track your progress, and provide a yearly breakdown to ensure you're on track to meet your objectives.