3 Reasons Why You Shouldn’t Trust Ramsey FIRE Calculator (Use a Smarter Alternative)

Planning for retirement is a big deal. You want to know when you can stop working and how much money you'll need to live comfortably. If you’ve ever searched for a retirement calculator, you’ve likely come across the Ramsey Retirement Calculator. It’s promoted as a tool to help you plan for retirement, but does it really do the job? Or is it just a populist tool that oversimplifies the complexities of retirement planning? 🤔

If you’re curious about FIRE, you deserve a better tool. But before we get to that, let’s dig a little deeper into why you shouldn’t trust Ramsey’s retirement calculator in the first place.

Contents

🤣 Shocking Discovery: We Reverse-Engineered Ramsey’s Calculator (It Took 5 Seconds)

If you’re curious about FIRE, you deserve a better tool. But before we get to that, let’s dig a little deeper into why you shouldn’t trust Ramsey’s retirement calculator in the first place.

3 Reasons to Consider Other Retirement Calculators

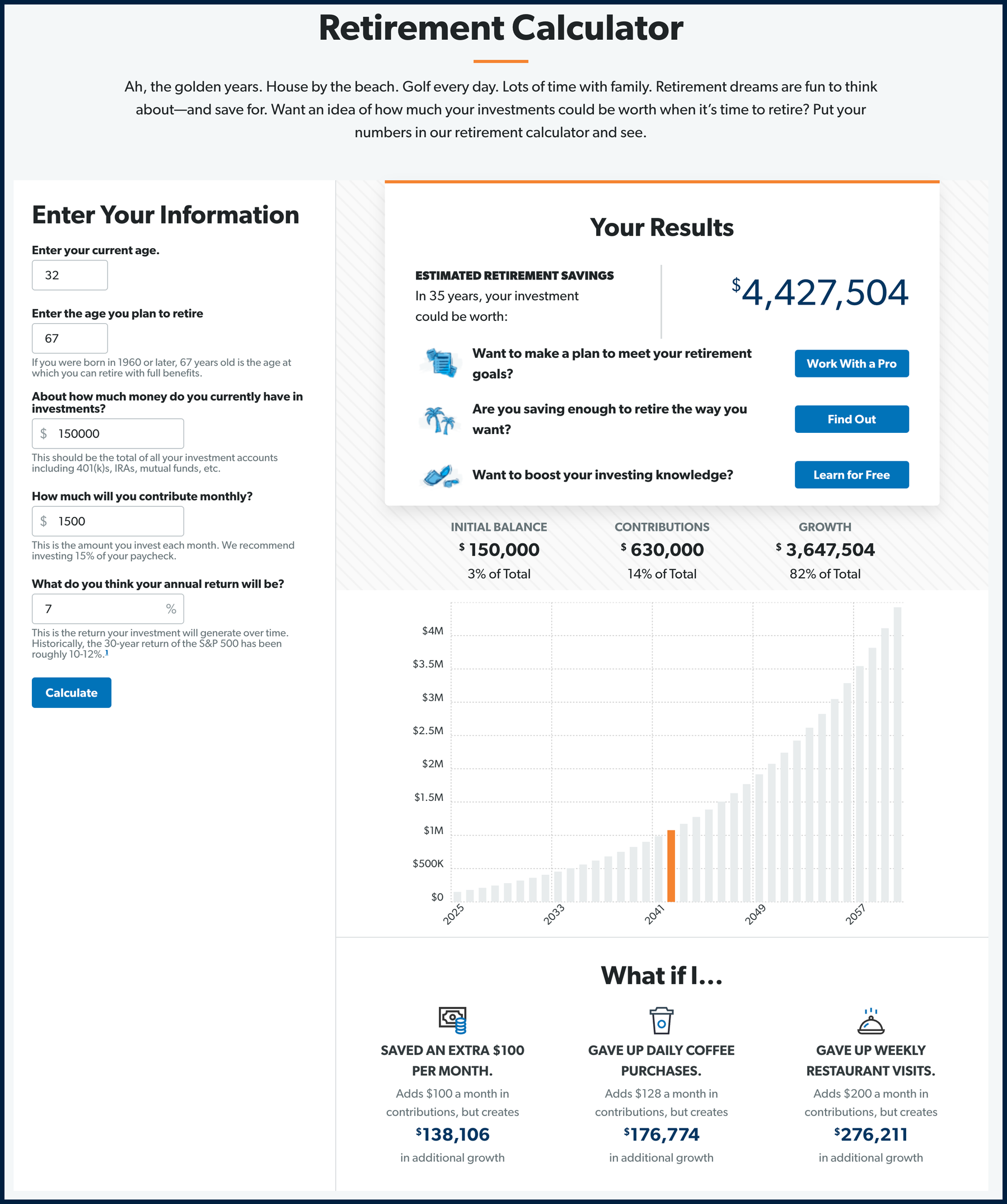

1. It Is Not a Retirement Calculator – It’s a Sales Pitch

The Ramsey Retirement Calculator might look impressive, but it's really just a way to get you to sign up for his financial services. Instead of giving you a true retirement plan, it asks for a few numbers and generates a simple savings estimate. 😒

💡 A true retirement calculator MUST CALCULATE your actual retirement age based on different scenarios, risks, and financial factors. A spreadsheet can’t replace that! This reason alone should be enough to start looking for other alternatives.

2. It’s Not Personalized (One-Size-Fits-All ≠ Smart Planning)

Retirement isn’t just about picking a date — it’s about figuring out if and how you can actually afford it. In reality, there’s no single approach that works for everyone.

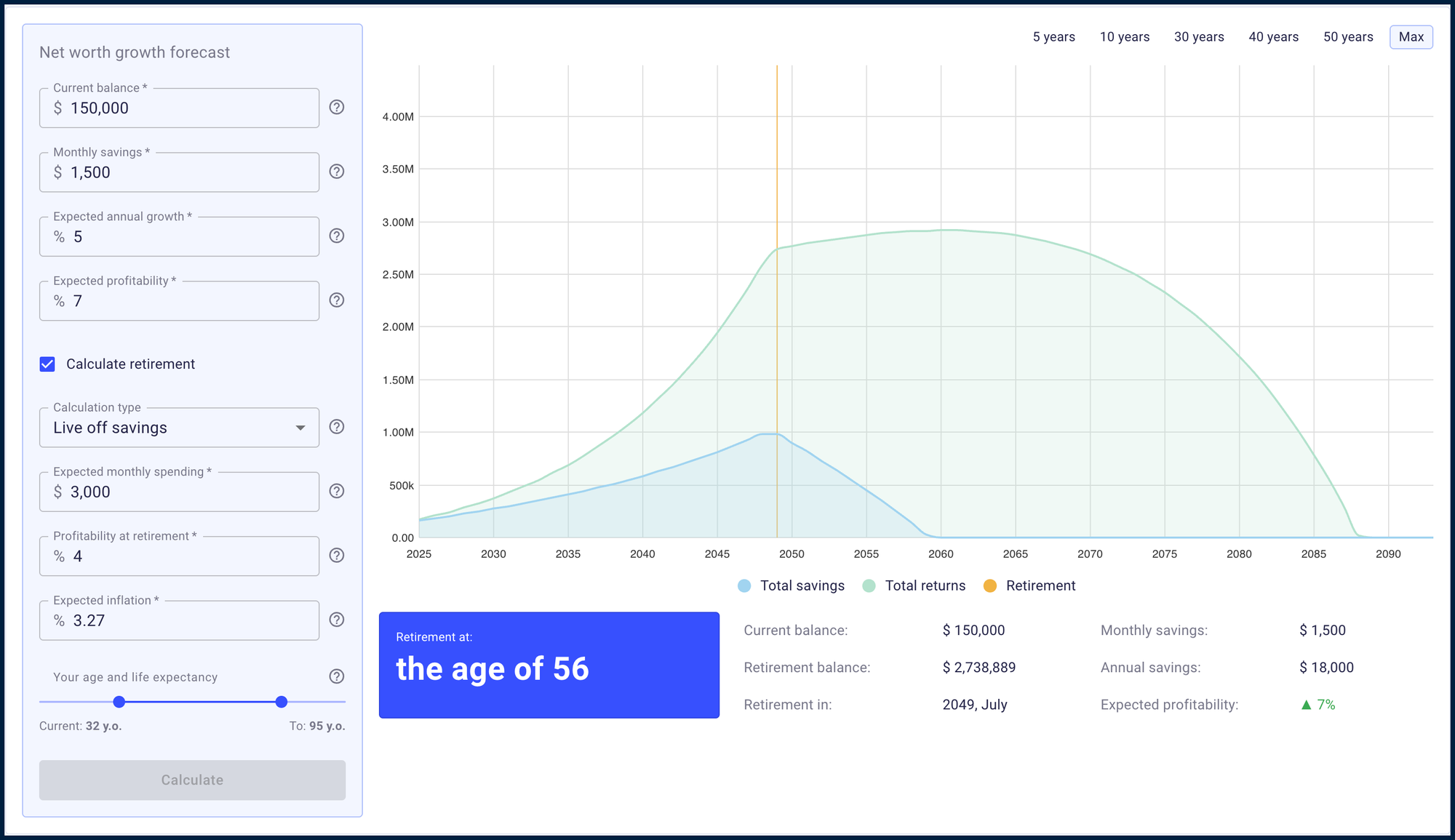

Some people aim to live off passive income, while others plan to spend down their savings over time. That’s why advanced retirement tools use complex simulations like Monte Carlo models or Binary Search testing to explore different financial outcomes.

⚠️ Ramsey’s calculator doesn’t do any of this. If you’re serious about FIRE, you need a tool that actually calculates your financial freedom date, not just a chart based on wishful thinking.

🔥 Try FIREkit! It tests multiple retirement strategies to find the one that fits you best. Whether you want to live off passive income or gradually withdraw your savings, it calculates your actual financial freedom date instead of just assuming 65 is right for everyone.

3. No Progress Tracking = No Real Planning

The truth is, that Ramsey’s calculator is nothing more than a basic spreadsheet. It might look useful at first, but beyond generating a simple table, it won’t take you any further.

📌 What’s missing?

To truly plan for retirement, you need to account for:

- ✅ Your personal goals and lifestyle needs – Retirement isn’t just about savings, it’s about what you want to do with your time and money.

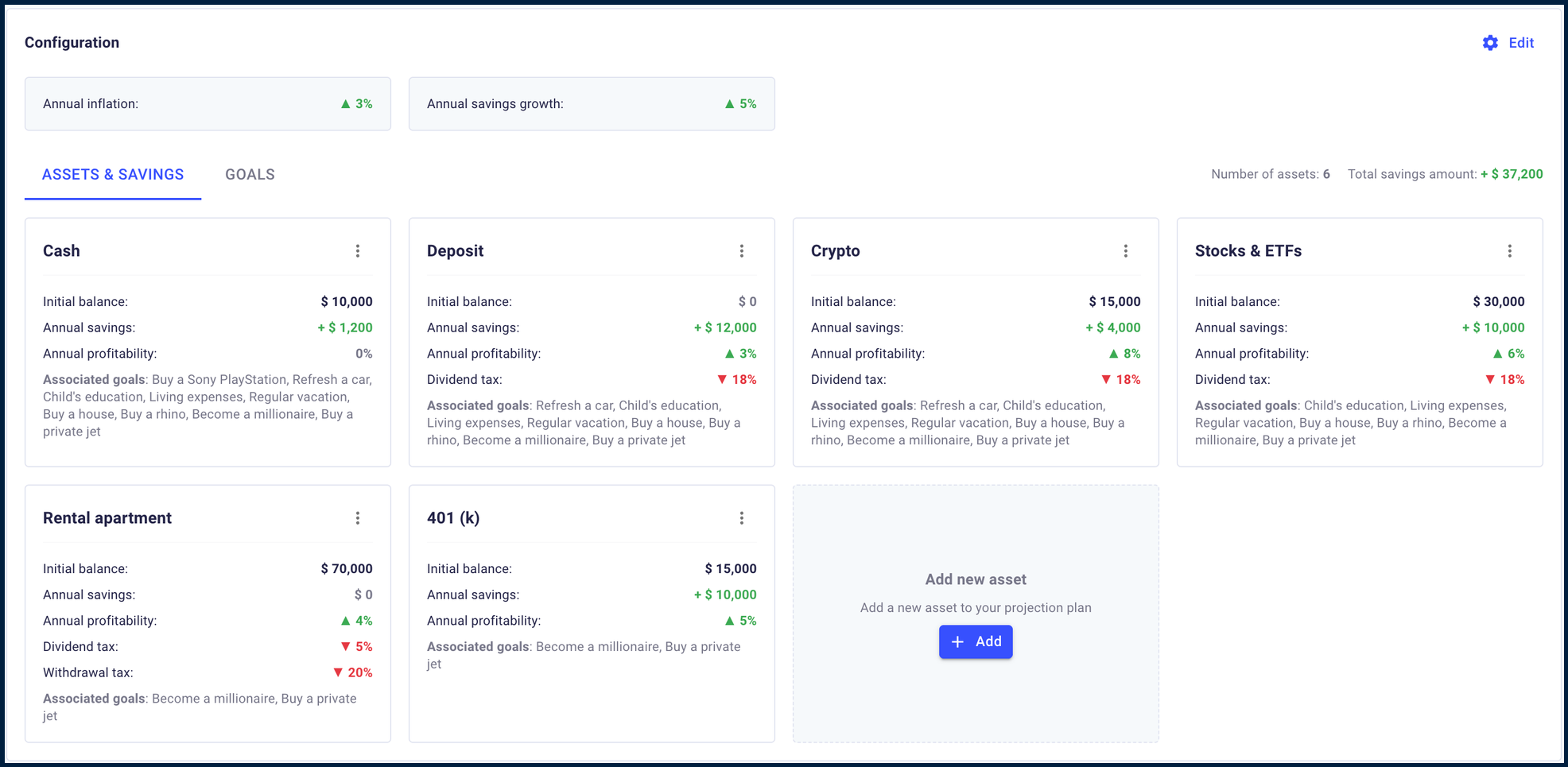

- ✅ Your actual assets and investment strategy – A real plan should consider where your money is, how it grows, and how it can support you over time.

- ✅ Ongoing tracking and adjustments – Retirement planning isn’t a “set and forget” process. You need to track your progress and adjust as life changes.

🚀 Smarter Alternative: FIREkit Retirement Planner

If you’re serious about Financial Independence & Early Retirement, you need more than just a basic savings table — you need a real planning tool that helps you stay on track.

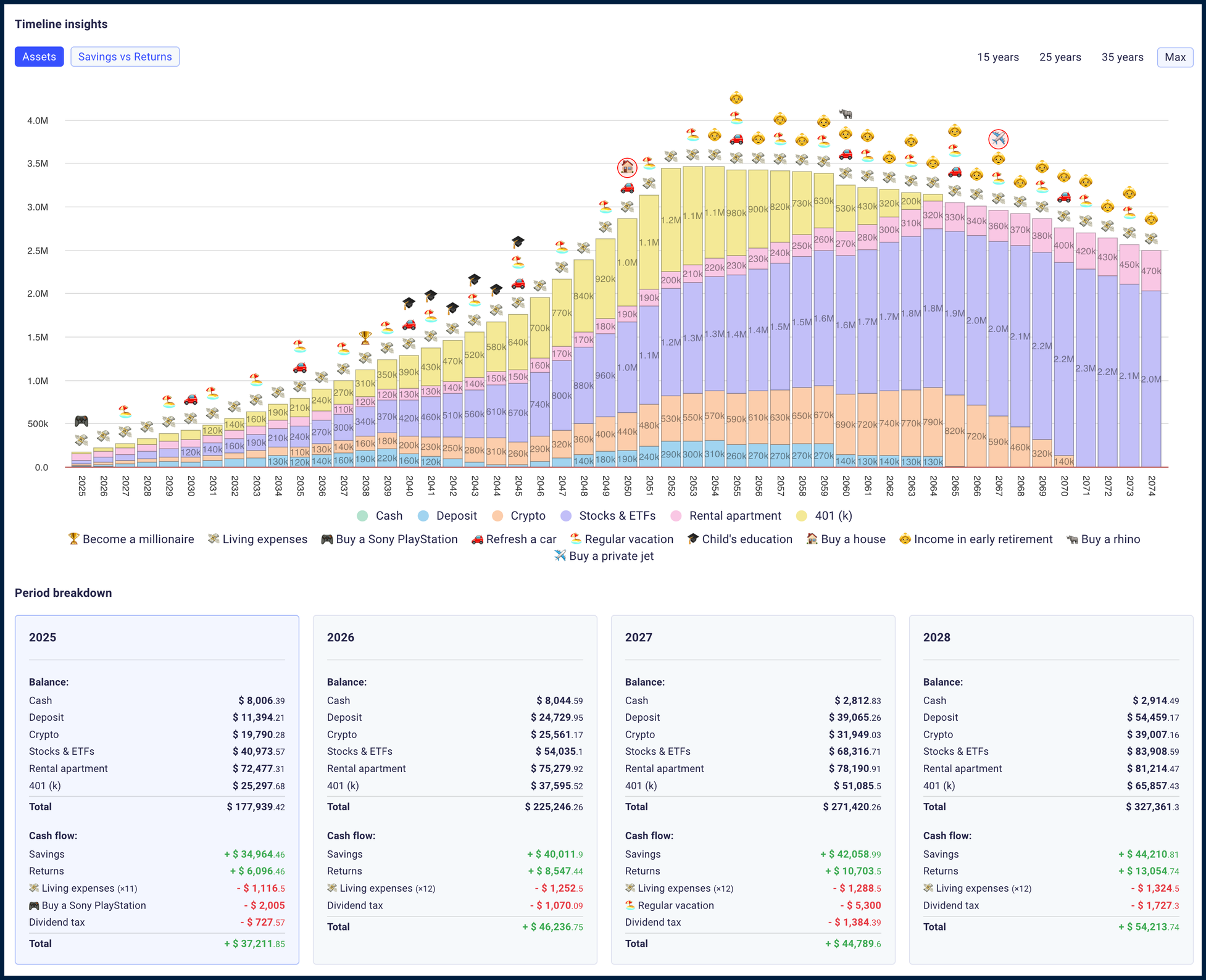

Track your actual assets

FIREkit considers individual returns, contributions, and even taxes to give you an accurate picture of your financial future. 💰

Supports multiple financial goals

Plan for early retirement, a home purchase, or any other goal, with inflation-adjusted projections. 🎯

Provides year-by-year breakdowns

See exactly how your net worth, savings, and withdrawals evolve over time. 📊

🎉 And the best part? It’s 100% FREE. No paywalls. No hidden fees. Just smart planning.

Ramsey Retirement Calculator vs. FIREkit

| Feature | Ramsey Retirement Calculator | FIREkit Retirement Planner |

| Personalized Planning | ❌ No, uses a generic approach | ✅ Yes, adjusts based on user input |

| Scenario Testing | ❌ No, assumes a single savings rate | ✅ Yes, tests multiple strategies |

| Tracking & Adjustments | ❌ No, only gives a one-time estimate | ✅ Yes, updates in real-time |

| Investment Growth Consideration | ❌ Limited, assumes fixed returns | ✅ Detailed asset-based projections |

| Tax & Withdrawal Strategies | ❌ No tax planning included | ✅ Accounts for real-world withdrawals |

If you want a real retirement strategy instead of a generic savings number, it’s time to switch to a smarter, more advanced tool. 🔥

💡 Try FIREkit Retirement Planner today and take control of your financial future! 🚀

Read more